PRESS RELEASE, December 28, 2021 — A Nordic Capital investment vehicle is exiting its investment in Vizrt Group to a new Nordic Capital-led consortium, comprising a secondary acquisition vehicle and other Nordic Capital investment vehicles. This transaction will allow Nordic Capital, alongside the Vizrt management team, to continue to support the business and its strategy over its next ownership cycle, providing capital to further fuel the strong growth momentum.

The secondary acquisition vehicle, which forms part of the new Nordic Capital-led acquiring consortium, was established with investment vehicles managed or advised by Goldman Sachs Asset Management’s Vintage Funds, Pantheon and Coller Capital as co-leads.

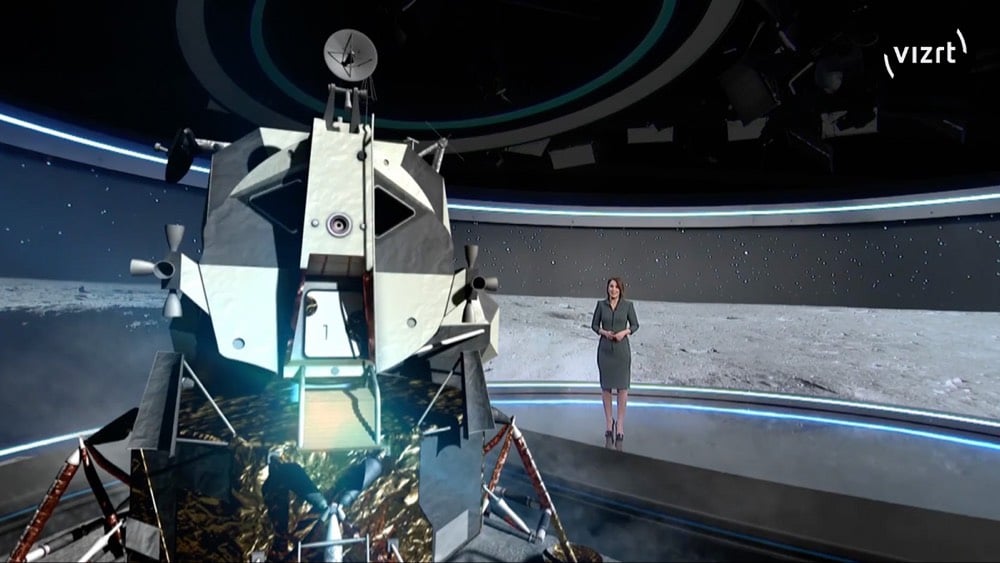

Vizrt is a global leader in production software for live video production, serving the world’s best storytellers from tier one sports and news producers through to corporate, education and Pro-AV markets. Building on Vizrt’s leading technology platform, strong customer relationships and reputation for operational excellence, Nordic Capital has entered into a strategic transaction to enable it to further invest through a new consortium led by it in the ongoing development of the business. The aim is to further support Vizrt’s continued transition to a SaaS business model, accelerate new offerings, expanding its operational capabilities and pursuing add-on investments to complement the offering and further accelerate the group’s growth.

Following Nordic Capital’s initial investment in 2015, Vizrt has continued its innovation leadership in graphics and live production software, successfully expanded into new markets and regions and is today a global leading software provider for software defined visual storytelling solutions. During Nordic Capital’s ownership, expansion initiatives and product investments has doubled Vizrt’s revenues and accelerated organic growth leading to tripled profits. Furthermore, a top tier, globally recognised management team has been added, high calibre talent has been attracted throughout the business, and the IP video technology focus has been further enhanced with the acquisitions of NewTek and NDI.

“Vizrt is an exciting company that has consistently performed during Nordic Capital’s ownership. This transaction is an opportunity for Nordic Capital to continue to support Vizrt’s high-caliber management team and to further develop the company which has an exciting future ahead with strong growth potential. Vizrt will continue to benefit from Nordic Capital’s strong capabilities as software investor with an outstanding network and know-how in operational excellence. We are excited for Nordic Capital to have the opportunity to continue the journey together with Vizrt’s team who share the same vision of building a leading video software company which will drive the industry shift to IP and cloud adoption”

— Fredrik Näslund, Partner and Head of Technology & Payments at Nordic Capital Advisors